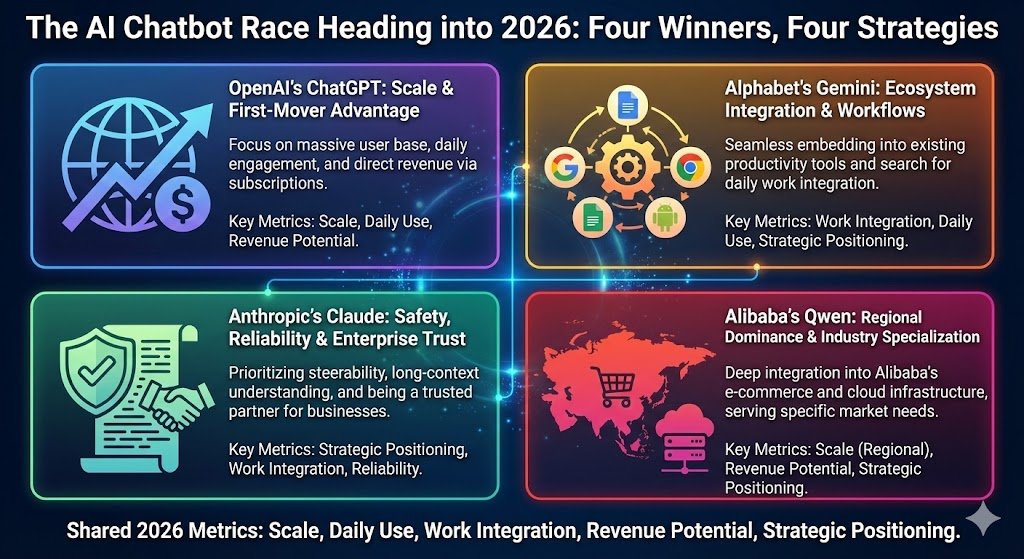

As 2025 closes, the AI chatbot landscape has crystallized around four clear leaders—each winning in fundamentally different ways.

Gone are the days when chatbots were judged on novelty or impressive demos. Investors and enterprises now evaluate these systems on metrics that actually matter: scale, daily use, work integration, revenue potential, and strategic positioning. When viewed through that lens, the competitive dynamics become remarkably clear.

Here’s how OpenAI’s ChatGPT, Alphabet’s Gemini, Anthropic’s Claude, and Alibaba’s Qwen are each carving out dominant positions—and what their different strategies reveal about where AI value will be captured in 2026.

ChatGPT: The Scale Advantage That Compounds

ChatGPT remains the undisputed leader in overall adoption, and the numbers are staggering.

OpenAI reports roughly 800 million weekly active users by late 2025, processing well over one billion prompts per day. No other chatbot comes remotely close to this level of engagement.

This scale creates compounding advantages. As hundreds of millions of users develop daily ChatGPT habits for writing, research, and routine work tasks, the platform becomes the default AI interface—the Google search of the AI era. That default status drives paid subscriptions (ChatGPT Plus at $20/month, Pro at $200/month) and lucrative enterprise contracts.

But ChatGPT’s real strategic moat comes from its Microsoft partnership. ChatGPT models power Copilot inside Office, Windows, and enterprise tools, giving OpenAI distribution inside organizations that would take years to build independently. Firms adopt ChatGPT capabilities without new rollout cycles or extensive training programs—it’s already embedded in tools employees use daily.

The ChatGPT Weakness: Cost and Speed

The primary limitation is economic. Advanced reasoning models improve output quality but add latency and computing costs that strain unit economics. OpenAI is reportedly spending more on compute than cloud credits can subsidize, with most inference costs now paid in cash.

This creates a delicate balance: maintaining quality and capabilities requires expensive infrastructure, but pricing high enough to cover costs risks pushing users toward cheaper alternatives.

Still, for most tasks, ChatGPT delivers high quality with unmatched accessibility. The scale advantage means OpenAI can spread infrastructure costs across a massive user base—an advantage that smaller competitors struggle to match.

Gemini: The Silent Spread Strategy

Google took a fundamentally different approach with Gemini, and it’s working.

Rather than building a standalone chatbot brand that users consciously choose, Alphabet embedded Gemini across Android, Chrome, and Google Workspace. This gives Gemini reach that doesn’t depend on users opening a dedicated chatbot app.

User numbers are less precisely reported than ChatGPT’s, but outside estimates suggest over 600 million monthly users by late 2025. Growth remains strong because Gemini is the default AI experience inside Google’s ecosystem—no separate download or decision required.

Where Gemini Excels: Long Context and Multimodal Work

Gemini’s technical strength centers on handling long documents and mixed media. Its large context window reduces information loss when processing lengthy files or complex formats—ideal for office work, cloud collaboration, and the kind of document-heavy workflows that dominate enterprise productivity.

This positions Gemini perfectly for Google Workspace adoption. Teams already using Gmail, Docs, Sheets, and Drive get AI capabilities that understand context across their entire digital workspace without switching platforms.

The Gemini Challenge: Brand Pull

The weakness is brand loyalty. When given an explicit choice, many users still reach for ChatGPT first. Gemini performs best as an embedded capability inside Google tools rather than as a standalone habit users consciously cultivate.

This distinction matters for premium monetization. Users will pay subscriptions for tools they choose and value. They’re less likely to pay extra for features embedded in platforms they already use—even if those features are technically superior.

Google’s bet is that silent spread through defaults eventually creates the kind of lock-in that monetizes through broader platform engagement rather than direct AI subscriptions.

Claude: The Trust and Precision Play

Claude occupies a completely different competitive position, and the numbers tell the story.

With approximately 30 million monthly active users in 2025, Claude’s reach is an order of magnitude smaller than ChatGPT or Gemini. But user count isn’t the metric that matters for Anthropic’s strategy.

What matters is who those users are and how they’re using Claude. Coding teams, research groups, and enterprises handling sensitive work gravitate toward Claude for long-text tasks and structured output. The platform has built a reputation for fewer hallucinations, better instruction following, and more reliable performance on complex prompts.

The Enterprise Revenue Signal

The real indicator of Claude’s strength? Enterprise API calls rose dramatically in 2025, signaling deep integration into production workflows despite limited consumer awareness. This suggests high-value usage—organizations building critical systems on Claude’s infrastructure, not casual users asking one-off questions.

Anthropic, backed by Amazon’s cloud infrastructure, designed Claude with safety and consistency as primary objectives. Reviews consistently cite predictable behavior and robust handling of edge cases—exactly what enterprises need when deploying AI into high-stakes environments.

Claude Opus 4.5’s achievement of 80.9% on SWE-bench Verified—the highest score among frontier models for real-world software engineering—reinforces this positioning. Professional developers choosing Claude for production work represents far more durable revenue than millions of casual users asking for recipe recommendations.

The Claude Tradeoff: Limited Reach

The obvious weakness is consumer scale. Claude lacks ChatGPT’s mass adoption and Gemini’s platform spread. Success depends entirely on business users staying loyal and enterprise contracts expanding.

This is a calculated tradeoff. Anthropic is betting that winning high-value professional users generates more sustainable economics than competing for maximum user count. Time will tell if the enterprise-first strategy can build a sufficiently large revenue base to fund continued development at frontier-model pace.

Qwen: The Open Source Kingmaker

Qwen represents an entirely different category of “winning” in the AI chatbot race.

Alibaba’s Qwen isn’t a major consumer chatbot. Public user counts remain low outside China, and it lacks the brand recognition of ChatGPT or the platform integration of Gemini. Yet Qwen may be the most strategically important model in the entire competitive landscape.

In 2025, TechLoy named Qwen 3 the best open-source AI model. The model uses a mixture-of-experts architecture and supports 119 languages, making it genuinely global in linguistic capability. More than 90,000 enterprisesreportedly use Qwen-based models on Alibaba Cloud.

Why Open Source Leadership Matters

Qwen’s dominance in open-source AI creates influence that extends far beyond direct usage metrics. When developers and enterprises want cost control, data sovereignty, and customization flexibility, Qwen becomes the foundation they build on.

This shapes the entire market in several ways:

Pricing pressure: Free, high-quality open-source models prevent proprietary providers from charging arbitrary premiums. OpenAI, Google, and Anthropic must price competitively knowing that Qwen provides viable alternatives.

Innovation diffusion: Techniques and architectures pioneered in Qwen rapidly spread through the open-source ecosystem, accelerating overall progress while preventing any single company from maintaining durable technical moats.

Sovereignty and localization: Governments and enterprises concerned about data leaving their infrastructure or being subject to foreign control can deploy Qwen locally. This is particularly important outside the U.S. and Western markets.

Developer mindshare: The next generation of AI engineers often learns on open-source models. Qwen’s prominence in that ecosystem creates long-term influence on how AI systems are architected and deployed.

The Qwen Limitation: Brand and Consumer Reach

The weakness is obvious: Qwen lacks a consumer application with daily engagement matching its technical influence. Its role remains largely behind the scenes—infrastructure that powers other applications rather than a direct user relationship.

This limits monetization options. Alibaba captures value through cloud services and enterprise licensing, but misses the subscription revenue and data advantages that come with hundreds of millions of direct users.

The Winners by Category Heading into 2026

When you disaggregate “winning” by what actually matters for different stakeholders, clear category leaders emerge:

Overall Scale and Consumer Adoption: ChatGPT

ChatGPT’s 800 million weekly active users and Microsoft integration give it the strongest position for capturing AI’s consumer opportunity. The network effects of scale—better training data, higher revenue to fund development, stronger brand recognition—compound over time.

For investors betting on AI becoming consumer infrastructure similar to search or social media, ChatGPT represents the clearest path to dominant market position.

Enterprise Trust and Mission-Critical Work: Claude

Claude’s reputation for reliability, combined with strong performance on professional coding benchmarks, positions it as the AI for work that can’t afford errors. Enterprise API growth despite limited consumer reach suggests product-market fit in high-value segments.

For investors focused on B2B software economics and sticky enterprise contracts, Claude offers a differentiated position that doesn’t require winning mass consumer adoption.

Platform Reach and Embedded Adoption: Gemini

Google’s ecosystem distribution gives Gemini access to hundreds of millions of users who may never explicitly choose an AI chatbot but use AI capabilities daily. This silent spread through defaults could compound into massive engagement over time.

For investors who believe AI value accrues to platform owners rather than standalone applications, Gemini’s integration into Google Workspace, Android, and Chrome represents the most defensible moat.

Open Source Impact and Developer Ecosystem: Qwen

Qwen’s open-source leadership shapes how AI gets built, priced, and deployed globally—especially outside Western markets. This influence extends beyond direct revenue to strategic positioning in the broader technology stack.

For investors concerned about geopolitical dynamics, market structure, or long-term AI architecture, Qwen’s role in the open-source ecosystem makes it impossible to ignore—even without ChatGPT-scale consumer adoption.

What This Means for 2026

The competitive dynamics heading into 2026 suggest several likely developments:

Consolidation around use cases, not total dominance. No single chatbot will “win” everything. Instead, we’ll see continued specialization: ChatGPT for consumer scale, Claude for enterprise reliability, Gemini for platform integration, Qwen for open-source flexibility.

Monetization models will diverge further. ChatGPT will focus on subscriptions and API revenue. Gemini will monetize through platform engagement and enterprise Workspace contracts. Claude will pursue enterprise licensing and specialized deployments. Qwen will capture value through cloud infrastructure and services.

The gap between leaders and followers will widen. The four players discussed here have established positions that will be difficult for new entrants to challenge. Scale advantages (ChatGPT), platform integration (Gemini), trust and reliability (Claude), and open-source ecosystem control (Qwen) all create compounding moats.

Technical capabilities will converge; positioning will differentiate. As models reach similar benchmark scores, competitive advantage will shift from “which chatbot is smartest” to “which chatbot fits best into my workflow, meets my trust requirements, or aligns with my strategic priorities.”

The Investment Perspective

For investors evaluating AI chatbot opportunities, the key insight is that “winning” isn’t monolithic.

ChatGPT (via Microsoft or OpenAI equity) offers: Exposure to consumer AI adoption at scale, network effects from massive user base, and potential to become default AI interface.

Gemini (via Alphabet stock) offers: Distribution advantages through Google’s ecosystem, diversified revenue streams beyond direct AI monetization, and platform defensibility.

Claude (via Anthropic equity if accessible, or Amazon exposure) offers: Enterprise AI positioning without competing on consumer scale, reliability reputation in high-value segments, and B2B SaaS economics.

Qwen (via Alibaba stock) offers: Open-source ecosystem influence, non-Western market positioning, and infrastructure value capture through cloud services.

The strongest portfolio position might be exposure to multiple strategies rather than betting on a single winner. Different chatbots capturing value in different ways suggests a market structure with room for multiple successful players rather than winner-take-all dynamics.

The Bottom Line

As 2025 closes and 2026 approaches, the AI chatbot race has matured beyond hype into measurable competition across distinct dimensions.

ChatGPT leads on scale and consumer adoption. Gemini wins on platform spread and embedded reach. Claude dominates on enterprise trust and mission-critical reliability. Qwen shapes the open-source ecosystem and non-Western deployment.

These aren’t competing strategies for the same prize—they’re different definitions of success in an AI landscape large enough to support multiple winners.

The organizations and investors who thrive will be those who understand these distinctions and position accordingly. There’s no single “best” AI chatbot heading into 2026—only the chatbot best suited for your specific use case, trust requirements, and strategic priorities.

Choose wisely. The decisions made in early 2026 about which AI platforms to build on, invest in, and integrate into critical workflows will shape competitive positioning for years to come.

Which AI chatbot has become most essential to your workflow? Are you betting on one platform or hedging across multiple? Share your perspective in the comments.